If your company practices any level of transparency, you know it’s often difficult to help your employees understand all of the financial jargon they will hear on a daily basis.

What better time than now to teach your employees basic business financial terms and help them understand what they mean? Use the terms and definitions below to complete this classic training bite to help your team learn 11 basic financial terms in 15-minutes or less.

11 Terms To Teach Employees

Sales Revenue - the income received by a company from its sales of goods or the provision of services.

Customer Returns and Allowances - is a contra-revenue account deducted from Sales. It is a sales adjustments account that represents merchandise returns from customers, and deductions to the original selling price when the customer accepts defective products.

Total Revenue - the total amount of a company's sales and other sources of income.

Cost of Sales - (also known as cost of revenue) and COGS both track how much it costs to produce a good or service. These costs include direct labor, direct materials such as raw materials, and the overhead that's directly tied to a production facility or manufacturing plant.

Total Cost of Sales - the accumulated total of all costs used to create a product or service, which has been sold. The cost of sales is a key part of the performance metrics of a company, since it measures the ability of an entity to design, source, and manufacture goods at a reasonable cost.

Labor Cost - the sum of all wages paid to employees, as well as the cost of employee benefits and payroll taxes paid by an employer. The cost of labor is broken into direct and indirect (overhead)costs.

Expenses - the cost of operations that a company incurs to generate revenue.

Repairs and Maintenance - the costs incurred to bring an asset back to an earlier condition or to keep the asset operating at its present condition (as opposed to improving the asset).

Profit Before Tax - a measure that looks at a company's profits before the company has to pay corporate income tax.

Gross Margin - a company's net sales revenue minus its cost of goods sold (COGS). In other words, it is the sales revenue a company retains after incurring the direct costs associated with producing the goods it sells, and the services it provides.

Interest Expense - the cost incurred by an entity for borrowed funds.

*Now complete the training bite!*

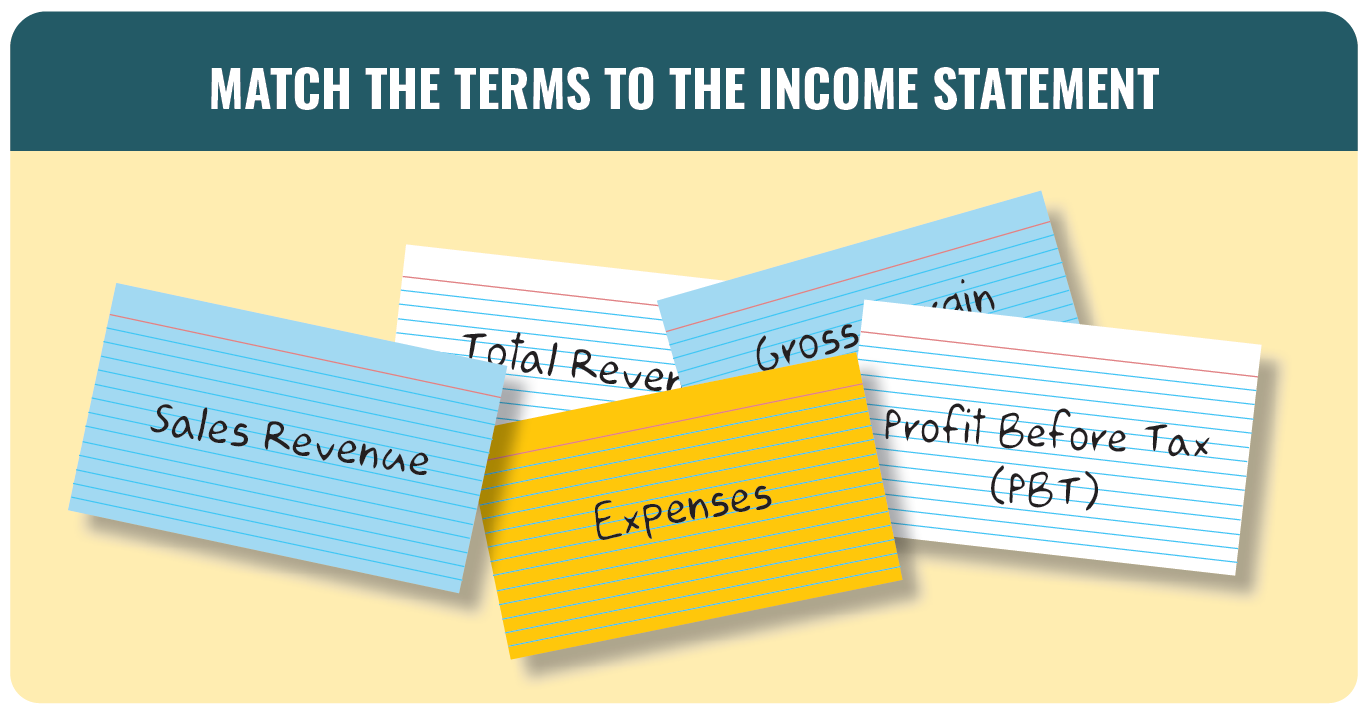

FINANCIAL LITERACY MATCH-UP

The Idea in Short:

Help employees develop a strong understanding of the financials by teaching them financial terms that are key to your business.

Approximate Time Required:

Prep Time: 20 minutes

Play Time: 10-15 minutes

Material Needed:

- Your company's Income Statement - highly simplified. (Note: The best alternative is to use your Huddle Scoreboard)

- Colored markers

- Large index cards or poster board (you will need multiple sets depending on the number of teams)

How it Works:

Using your company’s simplified Income Statement, write down one category and/or line item on each index card. (For example, Sales Revenue, Customer Returns and Allowances, Total Revenue, Cost of Sales, Total Cost of Sales, Labor Cost, Expenses, Repairs and Maintenance, Profit Before Tax, Gross Margin, Interest Expense, etc.)

Continue until you have a full set of cards that represent the categories and line items on your company’s Income Statement. Duplicate each set as needed for the number of teams involved in the employee financial literacy training.

Ask each team to work together to develop the company’s Income Statement by arranging the cards in order in which they appear on the Income Statement. As the team works to arrange the cards, the discussions (and/or debates) that follow provide a fantastic learning opportunity for all.

HINT: Depending on your employees level of understanding, you can also break out the categories or line items in more detail than your simplified Income Statement. This would allow them to learn more of what items may go into a specific line item. (For example, what goes into Sales & Marketing Expense? Travel & Entertainment, Advertising, etc.)

Make it Fun!

Divide the group into small teams of 3 to 4 people. Provide each team a set of the index cards and thumb tacks or two sided tape. In tournament style, ask two teams at a time to come to the front of the room and match up for the ‘P&L Line Up’ Game. Each team will then compete by racing to arrange the cards in the correct order in the quickest time. The team that arranges the cards in the correct order the fastest WINS.

HINT: Add a few categories or line items to the mix that don't belong on the Income Statement and create a little more action.

.png)

.png)

-5.png)