How Do You Know if You're Winning?

In sports, we enjoy the game because we can easily follow the action and keep score. By following the action and keeping score, we experience it all—the stories behind the score, what individual actions and team accomplishments changed the score, what plays made the difference, and ultimately how The Game was won. Every sport has its scoreboard, scorecards, and team stats—and so must every business.

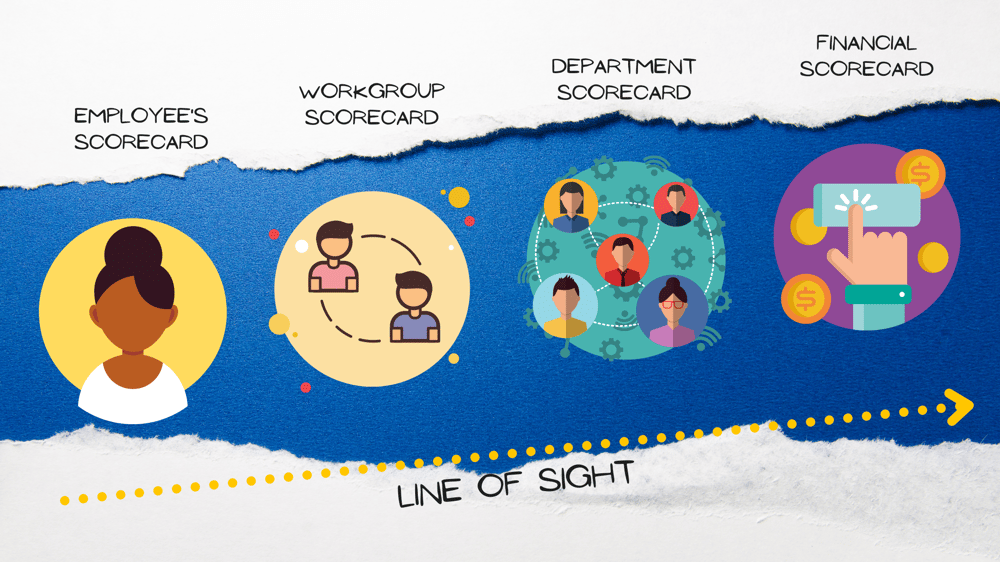

However, unlike sports, too many businesses are running their companies by focusing their players on the stats and only the stats, all without ever really knowing if they’re winning or losing. They have no visibility to the center-court scoreboard (the financials).

A number of years ago, while on a visit to a Fortune 500 company, we were proudly led through its expansive facilities as our guide lauded the extensive scoreboarding that was happening at every turn. Man, they measured everything. They had KPIs on safety, utilization, units, employee engagement, and even temperature. In total, they boasted an impressive 157 KPIs they tracked at any given moment.

A number of years ago, while on a visit to a Fortune 500 company, we were proudly led through its expansive facilities as our guide lauded the extensive scoreboarding that was happening at every turn. Man, they measured everything. They had KPIs on safety, utilization, units, employee engagement, and even temperature. In total, they boasted an impressive 157 KPIs they tracked at any given moment.

At the culmination of the tour, the executive beamed with pride when he asked what we thought of all this amazing tracking and measuring. Jack asked him, “So how do you know if you’re winning?” Dumbfounded, the exec retorted, “Well, we’re winning in some areas and struggling in others,” pointing to different scorecards in the meeting room. Stack asked again, “But how do you know if you’re winning? Are you making any money?” It seems the only thing that wasn’t being measured in that incredible operation was whether all their efforts were worth it. They weren’t watching the ultimate scoreboard—the financials.

Companies that focus only on KPIs can sometimes miss out on larger goals. Is it possible to be profitable and still run out of cash? Is it possible to hit quality goals and still lose a customer? Absolutely. Balancing all the aspects of business simultaneously is imperative, albeit challenging.

.png)