Introduction:

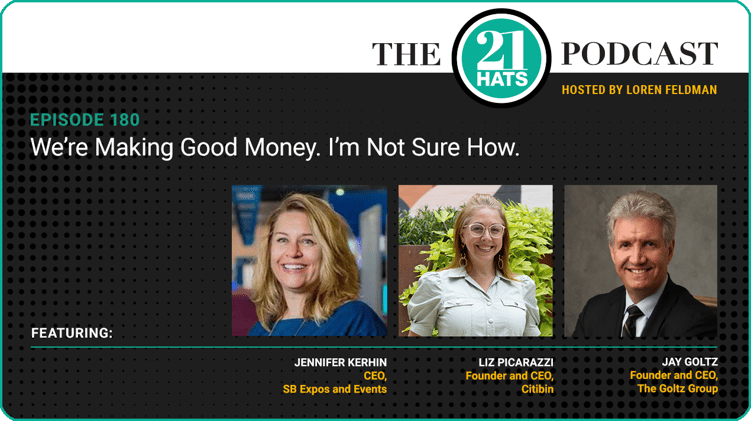

This week, Jay Goltz, Jennifer Kerhin, and Liz Picarazzi discuss their efforts to get a better grasp of what drives their profits. They ask how much of their finances they should manage themselves. And how much should they rely on an accountant or a fractional CFO? When does delegation become abdication? Jennifer says she’s benefitted from hiring a fractional CFO who has taken an active leadership role, including setting up a database that helps Jennifer see in real time whether the fees she’s charging cover the labor she’s deploying. “Whatever she’s charging me,” says Jennifer of her CFO, “it’s absolutely worth it.” Liz, meanwhile, thinks she should be doing more herself. And Jay says he was paying big bucks for a full-time CFO until late last year. “And it was a complete waste of money,” he says, which is why he’s decided not to replace her. Plus: Liz reveals her secret strategy for marketing directly to municipal government officials, some of whom have started to use the term “Citibin” generically. And the owners respond to a question from the head of a cost-reduction service who wonders why she’s struggling so much to get business owners to try her risk-free service.

— Loren Feldman

This content was produced by 21 Hats.

See Full Show Notes By 21 Hats

Podcast Transcript

Loren Feldman:

Welcome Jay, Jennifer, and Liz. It’s great to have you here. I asked this with last week’s group and got a surprise answer. So I’m going to try again. Did any of you make New Year’s resolutions this year? Anybody?

Jennifer Kerhin:

I made goals. Is that the same? Goals, rather than resolutions?

Loren Feldman:

It’s related.

Jennifer Kerhin:

As part of my Vistage group, which was a couple days ago, we had to present our four top business goals and our four top personal goals. And you had to do it in front of everybody with slides and accountability. And it was an important part of my late December planning. So yeah.

Loren Feldman:

Can you give us a couple of those goals?

Jennifer Kerhin:

Sure. One is, this year’s focus is on management. We have hired some amazing people, but I need to develop our inexperienced managers into strong managers—so, focus on training and development of management. Second is, implement a content marketing strategy. We have an entire content marketing strategy this year.

My third one is to actually have a good format and be prepared for my monthly meetings with my CFO. I have a fractional CFO and have not done a great job. And my final one is to… Ugh, I don’t remember my final one. Shoot. And then three personal goals. Yeah, three personal goals. One is, my 30th wedding anniversary this year. And so we are taking a two-week vacation to Spain—so to plan that, so that we have a lovely time.

Loren Feldman:

That’s right up your alley: event planning.

Jennifer Kerhin:

Yeah, absolutely. And then, redecorate my living room. Because I’ve hated it and ignored it for years. And then my final one is, I’m not doing dieting. I hate dieting goals. I hate weight loss as a metric. It’s more: be more active. So every day, I’m committing to 15 minutes of activity, whatever it is. Treadmill, walk down the stairs. I will commit to 15 minutes every single day. For those people who are athletes, they’re probably disgusted right now at this. But for someone who sits in a chair 12 hours a day, 15 minutes of solid activity is a big step for me.

Loren Feldman:

There’s a lot of good stuff in there. I want to come back to some of that. But real quick, Liz, did you set any resolutions this year?

Liz Picarazzi:

I didn’t set any formal resolutions, but I kind of looked at things that I want to make sure have happened or do happen. One is, I have a 17-year-old who is going to be going to college next year. So I want to just spend as much time as possible with her. I’m definitely starting to feel worried about that.

Another one with work, at least, is to really be looking for people I might want to hire. I do expect growth this year, and I don’t feel like I’m in a great place. I want to know who I’m going to hire once I need to. And I feel like it’s a pretty vulnerable position that I’m not there yet. And in terms of personal exercise, I don’t. I go on walks every once in a while.

Loren Feldman:

That’s exercise.

Liz Picarazzi:

I’ll go on more walks, but I’m not going to quantify it. [Laughter]

Loren Feldman:

Jay, how about you?

Jay Goltz:

Liz, if I can give you some—wait, I have to tell you, as someone who sent three kids off to college and remember the moment where they’re walking away from the car and you want to vomit, and you think, “Oh my god, did I spend enough time with them? Blah blah blah.” I tell this to everyone that’s been through that: You need to smile and remind yourself that there are lots of people who wish they were sending their kid off to college—to a college they want to go to. You have to remember that, because how fortunate are we and they that the kids grew up, and they’re okay, and they’re going to college?

Liz Picarazzi:

Right. Well, also, I need to not catastrophize her going to college. It’s a natural thing. But we were on vacation recently as a family. And I’m walking the Great Wall with Frank and Lydia. We’re having a great time. And all I have in my head is: This is the last time I’m going to do something like this with her. Which is not true. But in the moment when I think: Am I ever gonna do that with her again? You know what, I could, if I make it happen. But I definitely have this worry that this sort of style of spending time together as a family is going to change.

Jay Goltz:

Stop worrying. That’s the New Year’s resolution. Stop worrying. Write that one down.

Loren Feldman:

Is that your resolution, Jay?

Jay Goltz:

No, I’m not a big worrier. My New Year’s resolution is, after 45 years in business, you’d think I figured it all out or maybe most of it. But I have been through a tremendous transformation in the last 30-60 days that I need to make sure my managers are all getting good numbers so that they can manage the company better, including getting the inventory under control. And I wasn’t paying enough attention—if any attention—to it. So, I’ve only got that one thing. And if I get that—not if—when I get that going right, everything will be glorious.

Loren Feldman:

We’ll all look forward to that. There’s a lot to talk about there. Jennifer, let’s go back: The hiring of a fractional CFO, I think, is a new thing for you, right?

Jennifer Kerhin:

Well, I’ve had her for years. But to be honest, she was more—not behind the scenes—but she more took her direction from me. And to be honest, I would say up until about June of last year, she played more of a role of an accounting consultant. She really wasn’t what I would call a fractional CFO. And last spring, I was talking to her and she said, “You know what, Jennifer? Your growth is too fast, too much, for me to sit back and have you just ask me questions.” Because that’s really what she was, more like a consultant where she would sit, we’d meet—I don’t know, once a quarter, once every two and a half months—and I’d ask her some questions.

She’s like, “Unless you say no, I’m gonna take a firmer role and be the fractional CFO that I’m supposed to be and really be more involved and make decisions. Obviously, you have to approve them. But rather than sitting back and being passive, taking an active role in what this company needs from financial—and I don’t mean just reports, but analysis. And give me thoughts.” And since then, it’s been fantastic, the things that she’s done. And so understanding, I think, that consultant versus fractional CFO, the differences—and I’m so thankful she took that leap to tell me that. And what she’s doing now for me in the company is tremendous.

Jay Goltz:

I know exactly what she’s talking about. And I know what you’re talking about. She’s talking about putting in a dashboard that you can keep an eye on what’s going on, and as the company grows quickly, you’re gonna have some different financial needs. And it’s about monitoring those, and then about watching cash flow. That all makes perfect sense.

Jennifer Kerhin:

It does, Jay. And the company is now at the size of—she’s like, “It’s still a small company, but it’s a company that needs to have that analysis, that strategic oversight, that dashboard,” like you said, Jay, on the finances. And then she’s saying, “Here it is. Let’s look at it. Do you understand this? Watch that.” She told me in September the same thing: “Watch your receivables. They’re getting too far back.” I had $400,000 in receivables. She’s like, “Get on top of this.” It’s been a transformational time and a good one.

Jay Goltz:

You’re also blazing a new trail. It’s not like there’s a quote-unquote standard in the industry that you can follow. And I’ve been chasing that thing for 30 years, because no one ever got to my size. Therefore, I had no metric to look at. “Oh, your direct labor should be running X percent.” I’ve had to figure it out on my own, and it’s costly to do that. So I think you’re in a similar situation that you need to figure out.

Loren Feldman:

Jennifer, how big a fraction is your fractional CFO?

Jennifer Kerhin:

So I would say she’s now 10 percent. We used to meet, let’s say, every quarter, and she would spend a couple hours in preparation, and we’d talk. But now she’s probably working, I don’t know, 10 hours a week, maybe less. Maybe eight hours a week.

Loren Feldman:

And has that been a comfortable fit for you, in terms of affording what you have to pay her?

Jennifer Kerhin:

Yeah. Financially, it’s fine. She doesn’t work eight hours a week. What she does is more project-based. So she set up this dashboard. One of the things she did in the fall is we created our hours-utilization database. She did it. We’ve tracked hours for years, but I stopped looking at them in 2019, because COVID hit. And I just couldn’t look.

So, now she created this database. At a glance, any manager can go in, and they can look at ABC client, and they can say, “For this year, we scoped 200 hours, and we are already at 150. Let’s break it down. Where are those hours at? Are we going over hours? Why did we go over hours? Oh, well, we had two inexperienced staff on it. Okay, so this other person was training.”

We have this database that she created with our admin that’s fantastic. So one, it’s going to have us have management oversight into what’s happening in an easy way. Two, did I underscope it? What we do is, I don’t bill by hour, Jay. I bill by s scope. So, “Oh my God, did I scope 40 hours and it took us 100 hours? Did somebody we put on it scope-creep? Did the client say to them, and they just did it? And they shouldn’t have?”

Jay Goltz:

Or, this isn’t your fault. Maybe you figured it out, and you just have a needy client that’s calling you too much.

Jennifer Kerhin:

Yes! Yes!

Jay Goltz:

You can’t predict that. You know, you paint the house, you can figure it out. It’s going to take 73 hours to paint a house. You get a needy client, they could be calling you every day about everything. And you can’t predict that.

Jennifer Kerhin:

No, but this is giving us management oversight. When we did it in 2019, the CFO had set up a post event. So let’s say the conference was in September. In November, she would say, “Okay, you had scoped 100 hours; you spent 98.” Well, this time, it’s real time. And so, to go back, Loren, to your question, it’s not like I’m paying her eight hours a week. We agreed on this project. She took it on. So she worked really hard for like a month, and then she took off for, you know, three weeks of the holidays or whatever. But now, she’s introducing it, and she’s training my managers. She’s taking an active role in leadership, so that she can figure out, financially, how we’re making profit, because we don’t have a firm handle. We’re making good money. How? Where’s it coming from? Which clients? We don’t have a good handle on this yet.

Jay Goltz:

The key is, you don’t have the background to do that.

Jennifer Kerhin:

No. Not at all.

Jay Goltz:

Which is why it’s so valuable to have someone like this, because she’s done this, hopefully, at 30 other companies and has an idea on it.

Jennifer Kerhin:

Well, and this fractional concept is, in the past, she said to me, she goes Jen, “You’ve been treating me like a consultant that comes in once a quarter.” She goes, “I’m a fractional CFO. I should be ingrained.” So we got her into all of our systems. She’s on Slack. She now sees our files. She’s like, “I can help you make high-level business decisions that you were just feeding me information.”

And now I have her talking to my leaders. And she did a presentation in August to my senior leaders. She’s becoming an important aspect of the company, just on a fractional basis, because I couldn’t afford her. My company is too small to afford her full-time. Nor does she want a full-time job. But now I’m not treating her as, hey, a couple hours a month. She’s an important aspect on a part-time basis for the company’s leadership.

Jay Goltz:

And does she work for a firm? Or is she on her own?

Jennifer Kerhin:

It’s her firm and she has three accountants who work for her who do reconciliation and stuff. And then she’s the fractional CFO.

Jay Goltz:

And I looked into that just a month or two ago. My accountant goes, “Oh, maybe you should hire one.” And it was like $300 an hour, which doesn’t take long before, at my size, I might as well just have a full-time employee. Can you tell us, what does that cost?

Jennifer Kerhin:

So let me pull it up. A lot of the reports and stuff, she goes to the—I say accountants, but they’re really bookkeepers. She puts it to the much lower rate of the bookkeeper. But let me pull up her bill and tell you exactly how much I pay. I don’t really remember off the top of my head, but it’s been worth it. Whatever she’s charging me, it’s absolutely worth it.

Jay Goltz:

While you’re looking, let’s just set a baseline. If you were to hire a full-time CFO, at a company your size, maybe that’s $150,000 divided by 2,000 hours. So a full-time person would cost you $75 an hour. So I would expect—

Loren Feldman:

Although a company of Jennifer’s size normally doesn’t hire a CFO.

Jay Goltz:

No, no, for sure. I’m just saying to use it as a baseline. It’s obviously going to cost more per hour. But if for instance, if she was hiring her for 20 hours a week, she’d be better off just going and hiring a full-time person, but she doesn’t need someone 20 hours a week.

Liz Picarazzi:

Well, then I think a CFO would be a lot more than $150k per year. I would guess it would be up there, more like $200k to $225k.

Jay Goltz:

You know, if you’re not borrowing a lot of money, I don’t know that. Because that is the world I’m in. If you’re not borrowing a lot of money, and there’s not a lot of insurance stuff to oversee, I don’t know that. You’re right. It certainly is in that range, but—

Loren Feldman:

Jay, you recently told us you parted ways with your CFO. You were paying your CFO good money, weren’t you?

Jay Goltz:

And it was a complete waste of money, as it turns out.

Liz Picarazzi:

Wow.

Jay Goltz:

Yeah. Wow is right. I have now, believe it or not—

Loren Feldman:

Well, you told us that you thought you hired the wrong person. It wasn’t a good fit.

Jay Goltz:

I did.

Loren Feldman:

And she thought so, too.

Jay Goltz:

Yes, and the fact of the matter is, I’m not replacing her.

Jennifer Kerhin:

It’s $190 an hour. And then her assistants charge me at $85 an hour.

Jay Goltz:

You know what, that seems very reasonable.

Jennifer Kerhin:

And I’m telling you, the transformation… I’ve always valued her advice, for years. But what she has done since June, to become ingrained in the company for the amount of hours. So for the past month, in December, she spent 10 hours and her assistant, or bookkeeper, spent six. So it’s about 60. And it’s worth every single penny.

Loren Feldman:

I probably shouldn’t admit this, but I’m not familiar with the term “utilization database.” It sounds like something that’s been transforming for you, Jennifer. Is it just me? Do lots of businesses have utilization databases? Anybody?

Jennifer Kerhin:

I took this term from a branding agency that’s part of my Vistage group. And so, I don’t know if it’s out there, Loren. I just stole the term from her. It was “utilization rates.” So they say a standard employee should be working about 85 percent of the time. And so I’m trying to figure out, how much are my employees working on clients? How much are they training? And with hours database that the CFO did, so I can have insight into scope and pricing for clients, but then also staffing spending. I mean, did I hire a new person, and they’re spending all this time with a client, and then half their time they’re spending on training because they don’t know what they’re doing? So I don’t even know if this is a business term. I just stole it from somebody else in my Vistage group.

Jay Goltz:

You know, it’s funny you say that number, because I just went through an analysis of my direct labor. I do classes at the frame show, so I help people with their pricing. So I did this partially to be able to tell them, and the fact is, between vacation time, holiday pay, sick days, that’s 10 percent right there.

Jennifer Kerhin:

Yes, yes.

Jay Goltz:

And then I took another eight percent off just for breaks and meetings. So it’s funny, my number—and I came up with it myself—was that I’ve got about 82 percent. And I’m arguing that you’re getting 82 percent out of every dollar. So yours was right in line with mine. So I do think that the yield is clearly not 100 percent.

Jennifer Kerhin:

No, not at all. It can’t be. There’s no way it could be. But understanding that, too, when you’re pricing. Look, you have employees. These aren’t contractors, like you said earlier, that you’re just marking up. Every dollar is not billed to the client.

Loren Feldman:

Jennifer, it’s not that you bought a piece of software called the utilization database, and started filling it up. It’s that she is now keeping track. I guess your employees all fill out some kind of form that indicates how they’re spending their time. And then she compiles it and analyzes it?

Jennifer Kerhin:

Yes, my employees put their hours into ADP. And they assign it by client and by year, and then by department. So if you work in the sales department, you work on the client for 2024. And then if you’re in the operations department, your department’s operations, and the client and the year. And so she made a pivot table. It’s not like an access database. It’s a pivot table in Excel. She downloads the data from ADP, and she made this incredible interface so quickly. Within two buttons, I can see, on a client, how many hours they spent that month, who worked on it—I mean, it’s just fantastic.

Jay Goltz:

So when you quote a client a price, do you put some parameters? Do you say to them, “Okay, we’re figuring this is based upon giving you 300 hours a year.” I mean, so that you can call later and go, “Listen, you’ve used up all your retainer,” or whatever. Or is it open-ended?

Jennifer Kerhin:

It’s not hours. We do it by tasks. So let’s say, for trade-show operations, there are probably 20 different tasks. And so we’ll say, “Okay, this task, we’re going to do these four bullet points to accomplish this outcome. We expect it’ll take 50 hours.” I don’t go back and say, “You’re at 52 hours.” But I say, “Look, you’re asking us to do something outside of scope. We’re not going to do it.” Or, “Hey, what you’re asking for is so far past what we thought.”

It’s a little loosey-goosey—too much. Jay, what we do, there is a large component of independent meeting players that just charge by hour. And what I say is, you’re getting a company with a lot of backup, with different people and skill-sets. And we’re gonna do it by scope. I don’t know if it’s the right way.

Jay Goltz:

I mean, my only question is, if they turn out to be somebody who’s just using way too much time, I mean, how do you address that? “This has taken more time than…” I mean, I’m trying to see if there’s—

Jennifer Kerhin:

We do change orders. We do send a lot of change orders.

Jay Goltz:

Oh, good.

Loren Feldman:

Liz, I’m curious. I guess, two questions: One, have you hired fractionally at Citibin at all? And two, have you done this kind of analysis of your finances and your work that Jennifer’s describing?

Liz Picarazzi:

So in 2024, definitely everything with financial literacy and being on top of things is a huge priority for me and Frank. Both of us are really behind on where we need to be, and that ended up coming into focus at the end of last year, because—

Loren Feldman:

If I can interrupt—Frank, being your husband and COO.

Liz Picarazzi:

Yes, Frank is my husband and COO, and he’s a little bit more financially illiterate than me. [Laughter]

Jay Goltz:

But he’s not a fractional husband?

Liz Picarazzi:

Well, Jay, you never know. That’s my private life. [Laughter] We definitely need someone like that. As I listened to Jennifer, I think that this is something we can look for. I have a lot of other business owner friends who have fractional CFOs. So I think if I put it out to my EO group, I could get some recommendations. I think that I also would be looking for someone who would have an eye on valuation. I think I’ve mentioned I don’t plan on selling anytime soon, but from now on, I want to know my value. And I want to just have regular valuations done. So if I can find someone who kind of has an eye on that, and also has connections in those communities…

...

Read Full Podcast Transcript Here

.png)