Introduction:

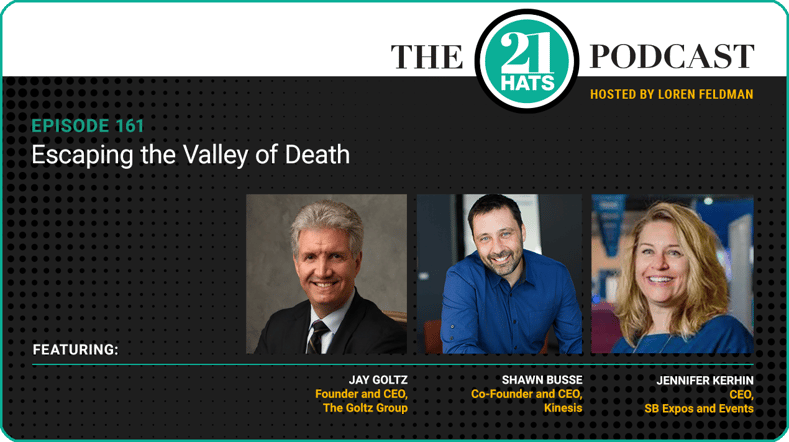

This week, Shawn Busse tells Jay Goltz and Jennifer Kerhin that he’s realized that his business, too—like Jennifer’s—is stuck in the valley of death that we first discussed a couple of episodes ago. Shawn’s realization prompts a discussion of what it takes to cross the desert and get out of the valley. We also have a surprisingly entertaining and enlightening conversation about insurance that makes clear why you should occasionally review what policies you have and why you have them. “I have something called directors insurance,” says Jennifer, “and I don’t really even know what that is.” Shawn notes that he found a company that helped him reassess several of his insurance lines. “What I like about that,” he told us, “is that while insurance brokers are incentivized to oversell you, because they make commissions,” this company sells its expertise and not policies. Plus: we start the episode with Jay explaining why binge-watching HBO’s Successionbrought back all of his worst nightmares about owning a family business.

— Loren Feldman

This content was produced by 21 Hats.

See Full Show Notes By 21 Hats

Podcast Transcript

Loren Feldman:

Welcome, Shawn, Jay, and Jennifer. It’s great to have you here. Jay, over the last year or two, we’ve spent a good bit of time talking about your attempts to come up with a succession plan. What I didn’t know through all that, was that while we were talking about your succession, you were deliberately avoiding watching the extremely popular HBO show Succession. Why was that?

Jay Goltz:

Well, I ended up watching it, as you know.

Loren Feldman:

Why did you delay?

Jay Goltz:

It wasn’t that deliberate. I’m thinking it was a little subconscious. I deal with stuff all day long at work. And I didn’t need to spend another hour or two before going to sleep on it. But I did break down and watch it.

Loren Feldman:

Once it was all over, and the final episode had aired, you started binge-watching it, as we discussed. You were ripping through two episodes a night. I don’t want to talk about the plot twists, especially since Shawn and Jennifer haven’t watched it yet. And I don’t want to give away any spoilers. And obviously, The Goltz Group is not Waystar Royco. But apparently, you found the show pretty relatable. What did you relate to?

Jay Goltz:

Well, I don’t know that I’d say relatable—cringe-able, let’s say. Here are the four pieces, which won’t be giving away anything. Number one, just watching your kids go at each other. I’ve got three kids. It’s just painful to watch. I have a document printed that I gave everyone in case I drop dead or whatever. But my biggest nightmare is my kids go after each other, which I don’t believe is happening. They all get along nice. But watching the kids go after each other was extremely painful.

Number two, watching their relationship with the employees of the company was extremely painful. Just every one of them. Between Geri, Karl, and Frank, I mean, they just had to put up with all the nonsense, and it was just painful to watch how they just were so disrespectful to them. And then you’ve got the father—there are two aspects to that. His relationship with his kids, and it’s just messed up. And on top of which, then you get the biggest one, which is, when does dad get to the point that you start whispering in back, “Dad’s losing it. We’ve got to take control of the company”? So that might be happening now as we speak. I’m not sure. But all four of those things are cringeworthy.

And then, I’m really embarrassed by the fact that I not only don’t have two, I don’t have a helicopter. What kind of loser am I that I don’t have a helicopter? [Laughter]

Loren Feldman:

Jay, you have a forklift.

Jay Goltz:

Actually, I have two. So I do feel better about that. Not to brag. So no, I was looking forward to getting through it. And I would say, as the father—if this was a film study group—I don’t think he deliberately played the kids against each other. I think he was just flailing at who’s going to be in charge. And I think he really didn’t know what to do. And the whole thing was just a mess.

I don’t relate to that. My kids are all good kids. They’re not doing any of the stuff those people are doing there. And I haven’t gone crazy… yet. You can argue that. But it was painful, to some degree. And I was absolutely looking forward to finishing it, because the problem was, I was watching it at night. We always did two a night, because I had to get through it. And then I would go to sleep, and this stuff was in my subconscious, and I didn’t sleep well sometimes. I needed to get done with it. And I’m done with it.

So it really wasn’t about succession. It was really about family business. I mean, all businesses have succession issues, but this was really about family business. And the kids were such brats. And there were a couple of scenes that were just noteworthy. One of them was when—

Loren Feldman:

Be careful.

Jay Goltz:

Well, I don’t think it gives it away—where Ken says to his father, “Dad, you gave us everything, and you resent us for it.” I mean, that’s a family business thing. And then when the father was at the end of his rope, and he just looked at all three of them, and he just goes, “You’re not serious people.” I mean, I think that really was the summary of: They were all screwed up. I kept going from who’s the worst one of the day, and it shifted over time.

Loren Feldman:

Did you learn anything from it?

Jay Goltz:

Absolutely not. I really didn’t. I knew all those issues. I can’t say I looked at it and thought, “Oh, wow, that could be me.” No, I really didn’t. I mean, it was an extremely well-written show, extremely well-written. But just as a business owner who’s got three adult children—one of them isn’t in the business. But it’s just… I was screaming at the TV sometimes. They were so rotten to the employees. It was just painful.

Loren Feldman:

I thought you said you weren’t crazy yet.

Jay Goltz:

Yeah, well does that make me crazy? I don’t know. There were a couple of scenes where it was just like… The way they treated Geri was just unbelievably horrible. And it was painful to watch.

Loren Feldman:

Shawn, Jennifer, is there any particular reason you haven’t watched it? I know you’re busy people. Are you avoiding it, or you just haven’t watched it?

Jennifer Kerhin:

I think I just haven’t watched it. But then, also, there’s a part of me that, when a lot of people are doing something, I tend culturally to run the other way. And I’m not sure why. I think that’s a character issue of mine.

Loren Feldman:

That’s a good instinct, I would say. How about you, Shawn?

Shawn Busse:

I watched maybe an episode when it first came out. And it was so painful that I just had to stop. I mean, we were coming off of the pandemic, and it was just a really shitty time in general. And I just didn’t need more crappy human beings in my life, so I just turned it off. And then, because I knew we were gonna talk about it, I watched like three episodes, and I still don’t regret turning it off.

Jay Goltz:

No, you can’t leave out the part that it’s clearly about Rupert Murdoch and his family. And we’re living it. So yeah, that added to the pain of it.

Shawn Busse:

I mean, I think what’s interesting about it—and you touched on this, Jay—we’ve worked with a lot of family-owned businesses over the years. And some of the dysfunction in that space… I really feel badly, and I mostly feel badly for the children. Because the common behavior I see is the parent wants to pass on the business to them, but then they actually can never really let go. And that’s a tough place to put a kid in. But then the kids in that show are just deplorable! So I don’t know.

Jay Goltz:

That’s what’s interesting. They’re deplorable, but all of them had something good in there. There were some good parts of each one of them. They weren’t all evil. All three of the kids, I wouldn’t call them evil. I’d call them screwed up. But each one of them had something going for them, and it was just painful to watch that get smushed by the negative side of it.

And I have to tell you, I feel good that I don’t have a dysfunctional—my kids bring up stuff to me all the time that I wasn’t thinking of, that maybe no one else would say to me. And it keeps me thinking about stuff that I should be thinking about. So it’s been a healthy, productive situation. So no, I don’t relate to it. But watching that stuff, it was just like everything you don’t want to do to run a company.

Shawn Busse:

I mean, I think I had to turn it off. There was that scene in the beginning where they’re playing the baseball game.

Jay Goltz:

Oh, yeah. Ugh.

Shawn Busse:

They offered to pay the kid a million dollars if he hits a home run, and then the guy tears the check up in front of the kid.

Jay Goltz:

That was probably one of the times I screamed at the TV.

Shawn Busse:

Yeah, it was so bad. Jennifer, I support your decision. You’re right, Jay: good writing. It’s Shakespearean in a lot of ways. But also, man, that energy is pretty negative.

Loren Feldman:

All right, let’s talk about something we can all relate to, and that’s the insurance business. Not necessarily quite as exciting a topic, but as you all know, there’s been a lot of bad climate news lately, including wildfire smoke and the hottest days ever recorded. And I believe a tornado in Chicago, Jay.

And it follows news that some insurance companies are simply refusing to write home and business policies in specific states, especially California and Florida. And in Florida, 10 insurers have gone belly up in the last two years. Are you guys at all concerned about this? Anybody?

Jay Goltz:

Not me. I can tell you why. You just answered it. 10 insurance companies are going broke. How many insurance companies are there? Probably a thousand.

Loren Feldman:

10 in Florida.

Jay Goltz:

I know. I’m just saying, this is typical, sensational news. My guess is, there are a thousand insurance companies. So it’s not like they’re all running out of state. And I believe in capitalism, that when they pull out, another insurer will step in and get more money, for sure.

And yes, the article I just read said that their insurance rates have gone up a couple thousand dollars. Okay, their insurance rates have gone up a couple thousand dollars. You know, they’re living in Florida. You know, taxes are lower there. It’s like, they’ll have to pay more insurance. But it’s not like half the insurance companies have gone away. Some insurance company’s gonna make a lot of money on this, because they’re gonna step in there and charge 20 percent more. And it’ll all be okay. Capitalism works.

Loren Feldman:

Shawn, you’re not in California. But you’re close. Have you seen any impact on your insurance?

Shawn Busse:

Not yet. I mean, the risks in Oregon are earthquakes and wildfires. So a number of providers have eliminated the earthquake rider. Like, it’s really hard to get earthquake insurance for your home. And if we were to have the kind of earthquake that we’ve had historically here before, it would be on a scale you can’t even imagine—because very few folks actually have any kind of protection from that.

So that’s, I think, our number one risk in this region. And folks are just sort of turning a blind eye to it. And then wildfires are pretty real. We’re in an urban center. We get a lot of water here. So it’s a little bit less of a risk than California. But I think it’s a thing. It’s like what Jay said. It’s just going to increase the cost of doing business, and businesses will adjust to it and move on.

Jay Goltz:

I can think of 10 other things that are far more serious that are endangering small business than your insurance rates are going up. That’s just kind of my point. Okay, you’re gonna spend a couple thousand dollars more. Okay. The technology problems? I just deal with stuff on a daily basis that is far more expensive than $2,000, or $5,000, or whatever.

Shawn Busse:

I think it’s more relevant for homeowners, which then becomes relevant for employees, which then becomes relevant for your workforce and so forth and cost. I think it’s another compounding factor to the extreme cost of housing. I think that’s where I think the problem is going to be. It’s going to be more expensive for housing, which puts pressure on employees and makes it more difficult to have stability. I think that’s what I would worry about, if I were a business owner, more than the $2,000.

Jennifer Kerhin:

And Shawn, I really do believe, for all the difficulties, the remote workforce is only going to grow. Because housing prices are so expensive, as they go try to find where they fit and can afford the quality of life they want. They don’t have to leave the job behind, necessarily, anymore.

Jay Goltz:

I agree with what you’re saying, kind of. Meaning, you’re right, this is going to support the remote workforce thing. But I don’t think it’s going to necessarily grow. I think it’s going to shrink first and then shrink less because of this. But I don’t think it’s going to necessarily grow from where it’s at. I fully agree with you. It’s not going away, and this is going to reinforce it, for sure.

Jennifer Kerhin:

Oh, I disagree.

Jay Goltz:

You think it’s gonna go up from where it is right now?

Jennifer Kerhin:

Absolutely. You know what I see? We’ve all heard a lot of commercial buildings are now going to be office buildings retrofitted for apartments and condos. The housing market’s a much higher need, and the supply is very low. So that’s going to escalate that when there are less office buildings.

Jay Goltz:

And if I had a zillion dollars to invest, I would be buying office buildings at some tremendous discount. My guess is they’re overreacting to this. That’s my point. I think it’s absolutely not going away. It will be a substantial part. But my guess is they’re overreacting to this, because I don’t think half the world’s gonna go remote. I don’t think they can, for what they do.

Jennifer Kerhin:

I would buy it to convert to an apartment.

Shawn Busse:

Man, there’s a lot of stuff here. This will be an interesting episode to return to, Loren. I think we need to return to it in about a year to 24 months. I think the commercial market is going to become absolutely devastated in the near term. The cellphone records, which are showing: Are people actually going into the office? It’s really bad, especially in places like inner core San Francisco. Even Portland, it’s decimated. And what’s happening is these commercial markets, they’re just sort of pretending it’s not going to happen. But it’s going to collapse. It’s in for a rough ride.

Jay Goltz:

But if you look at history, with real estate, it always overreacts. So yeah, it’s absolutely gonna go down. But I’m suggesting there are gonna be some banks running for the hills just selling buildings for dirt cheap. I bought my factory building in 2008, and I got a super good deal on it, because in 2008 nobody was buying anything, and I bought. So I think there are gonna be some opportunities just because, like I said, I believe some banks are going to overreact and just want to get it off their books. And the conversion from office to residential is very, very, very expensive—just putting in bathrooms and kitchens. I mean, it’s easier said than done.

Loren Feldman:

Back to insurance for a moment, there are people who are referring to the price hikes as kind of a canary in the coal mine, with regard to big climate events. I’m wondering, how many of you have business-interruption insurance?

Jay Goltz:

I do. Because I was told 30 years ago that if you don’t have it, the insurance company’s not in a real big hurry to settle your claim. Whereas if they’re paying for your business interruption, they get in gear and get it fixed quicker. And that makes sense to me.

Loren Feldman:

Jennifer or Shawn?

Jennifer Kerhin:

I do. I have it. Could I tell you what it says and how much money I have? Absolutely not. That is yet another thing I have to put my eyes on. I have a lot of insurance. Somebody once told me I’m over-insured. And I really don’t know what my insurance does. I have something called directors insurance, and I don’t really even know what that is.

Jay Goltz:

Well, that means that anyone who works as a director, which you don’t have—I don’t even know why you would have that—if they get sued, they get covered. Or if you’re on a board, like if somebody sues 21 Hats, maybe you’re covered for giving bad advice.

Jennifer Kerhin:

Yeah, I’m gonna put that later next year. But I have to reevaluate what I have, and why I have it.

Shawn Busse:

Yeah, I found a service that I’m really bullish on last year, where you actually pay them for their expertise, and they help you evaluate your options in this arena.

Jay Goltz:

Wow.

Shawn Busse:

And what I like about that is that insurance brokers are incentivized to oversell you, because they make commissions. And so, basically, you’re paying them for their professional advice. They’re not actually selling you the policy. So I found that to be really valuable, because you’re exactly right, Jennifer. It’s hard to keep track of what you actually need. And I was underinsured in some areas very, very badly, and over-insured in some other areas.

Jay Goltz:

I will tell you, I had my cars years ago with State Farm, and I called the agent. I said, “I don’t think I have enough liability coverage.” He goes, “Well, you’ve got what’s average.” And that kind of says it all. I go, “I’m not the average client. I own a successful business, and if I get into an accident, they’re gonna go after me.”

And I changed insurance because of that, because he really didn’t get it. That was a bad answer. I shouldn’t have the average insurance. When you own a successful business, you need more insurance. And State Farm is not for someone who owns a business, usually.

Shawn Busse:

It’s a commodity.

Jay Goltz:

Yeah, right.

Jennifer Kerhin:

Well, add that to the hats that we have to wear, is understanding.

Jay Goltz:

Insurance is one of the hats, for sure.

Shawn Busse:

Yeah. Do you have an umbrella policy, Jay?

Jay Goltz:

Yeah, absolutely. And I tell everybody this. I just did a speech yesterday with a bunch of designers, and they were talking about insurance. They laughed when I said this, but it wasn’t meant as a joke. It’s legitimate: If you’ve got kids, the day that they get a driver’s license, you ought to get an umbrella policy, because your risk has gone up dramatically. When you’ve got teenage drivers driving your cars, it just makes sense.

And people laughed like it was a joke. It’s not a joke. If you’ve got more than one kid, then much more. I mean, before your kids are driving, you have a moderate amount of risk in your life. The second you stick the 16-year-old in your car, your risk goes up dramatically. So I’ve had an umbrella ever since then. And I can tell you what it costs, cause I know. I think it’s $350 a year for $2 or $3 million. It’s not expensive.

Shawn Busse:

Jay, what’s the name of the insurance you can get for when an employee sues you? Do you know the name of that?

Jay Goltz:

Yeah, there is a name for that. Here’s how you can get sued. You give health insurance to your employees, and whoever’s in charge of it forgets to sign somebody up or something happened. The person has a heart attack, goes to the hospital, rings up a $300,000 bill. And, “Oops, we didn’t have you signed up. Oh, yeah, you did tell me to sign you up. Oh, I was on vacation that week, and I forgot to do it.” I mean, that’s omissions. I think it’s called omissions.

Jennifer Kerhin:

Oh, I have that one too! [Laughter]

Jay Goltz:

There you go.

Jennifer Kerhin:

I just pulled up my list. Hey, Jay, you mentioned that you have people traveling the world as buyers, right?

Jay Goltz:

Yes.

Jennifer Kerhin:

Do you have special health insurance for health disasters?

Jay Goltz:

No.

Jennifer Kerhin:

So I bought some recently.

Jay Goltz:

There you go. It sounds like you’ve got everything.

Jennifer Kerhin:

Yeah. Well, it was super cheap. Honestly, it wasn’t that expensive.

Loren Feldman:

Jennifer, is this insurance specifically for people who have a health problem overseas?

Jennifer Kerhin:

Yes. It doesn’t mean you have a health problem. It just means if something happens overseas, I covered health expenses, and then emergency evacuation.

Shawn Busse:

Oh, wow.

Jay Goltz:

There’s only one thing I know for sure, Jennifer. You have the greatest insurance salesperson ever. [Laughter] That’s the only thing I know for sure.

Read Full Podcast Transcript Here

.png)