Introduction:

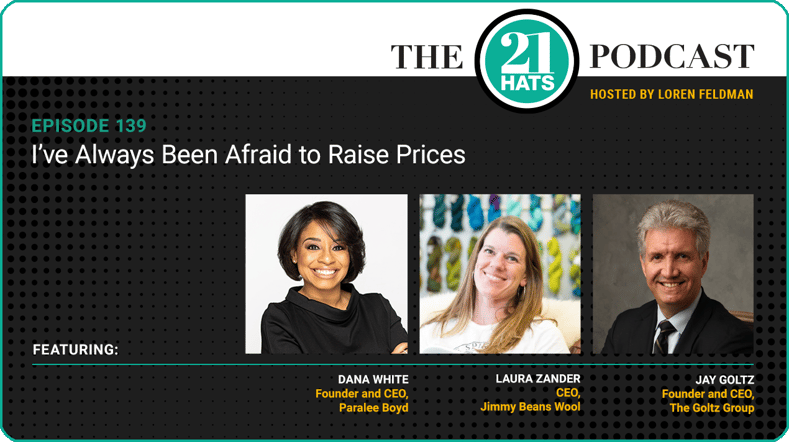

This week, Jay Goltz, Dana White, and Laura Zander have a wide-ranging conversation that starts with the challenge of pricing. Do you set prices based on what you think the market will bear? Or do you set prices based on your own rising costs and what you need to charge to make a profit? And how much profit should a business expect to make? Along the way, the owners also discuss why Laura wants to keep buying businesses (don’t tell her husband, Doug), what Dana needs to do to get her new salon open at Fort Bragg, and why both Dana and Laura are going all-in on influencer marketing. Jay, on the other hand, isn’t entirely convinced that social media marketing works for his picture-framing business. Plus: Should a business owner know every employee’s name? What if you have 130 employees?

— Loren Feldman

This content was produced by 21 Hats.

See Full Show Notes By 21 Hats

Key Takeaways:

You've gotta charge what you've gotta charge. Your company has to be profitable.

Jay Goltz:

And the problem is, no matter what business you’re in, somebody’s going to complain about the price. And that gets in your head like a worm, and it gives you pause, and you start to think about that person. And the part that you haven’t figured out is: If you’re charging, in your case, $90 to do their hair and you get 10 customers, if you lost two because of the price, you’re still going to make more money than if you charge eight people $50 or $60. Like, you’re gonna make it up. You gotta charge what you gotta charge.

Adjusting pricing to cover expenses like taxes.

Jay Goltz:

Well, I’m spending a lot more time on just figuring out projections, because my business model has changed a little bit. My real estate taxes have just gone up dramatically. I’m paying half a million dollars a year just for real estate taxes. That’s a lot of money. And like, where does that come from? And I’ve got to relook at my pricing and my budgets and figure it out. And then slowly but surely—and I’m not complaining about this—

Loren Feldman:

You’ve mentioned your pricing before.

Jay Goltz:

I’m still working on it. Yeah, I’m going back to ground zero, which I have a handwritten formula from 30 years ago that we were working off of. So I’m having to relook at the whole business model, because the minimum wage in Chicago was going up to like $15.80. And you know, it’s gone up a lot. And I’m not complaining about it. It’s fine. And now you get five sick days per year, that’s built in. So my cost of labor has gone up, and the cost of the real estate taxes have gone up, and the cost of maintaining the buildings keeps going up. And it’s got to come out of somewhere.

Laura Zander:

But those real estate taxes are your responsibility personally, right? It’s not the business—just to be clear?

Jay Goltz:

No, no, it’s the same difference. If I was a third party, you’d still end up paying the taxes. Someone’s paying the taxes. That’s what they call a triple-net lease. So the tenant always ends up paying the taxes. I have to really look at all of my pricing, because just keeping my heating going in the building. Every time the guy comes out, “Oh, I had to replace the valve.” You know, $2,300. It’s expensive. And then for Jayson Home, for shipping stuff around the country, I’m paying out tens of thousands of dollars every month for white glove delivery. And I’ve gotta make sure that’s covering it.

Loren Feldman:

Do you charge him for shipping separately, or do you build it into the price?

Jay Goltz:

Yeah, yeah, I do. And then you’ve got stuff shipping from all the containers coming over from Europe. So it crept up on me, but I’m really spending a lot of time. And then, I’ve got my kid in my head when I’m looking at the budgets. And I hear him going, “Gee, is that really enough money to make?” And he’s not wrong. I mean, it comes down to the basic question of, “What should the bottom line of a company be?” And I’ve been in lots of business groups over the years, and it’s always a nebulous number. How much can a company make? And there’s no quick and easy answer to that.

Laura Zander:

Your CFO doesn’t answer those questions for you?

Jay Goltz:

My CFO has been here a year, and she’s got enough on her plate to just take over the antiquated computer system and work on getting—no, she’s just got too much on her plate. And she doesn’t understand the business. She doesn’t understand the business at all. I mean, she’s just been here for a year. I’m the one who knows how to frame a picture. So yeah, I’m working on it.

Understanding return on equity vs. return on investment and how much profit a company should expect to make.

Jay Goltz:

Well, first of all, you’re giving the heart and soul of the company to a third party. If that gets messed up, you’re out of business. And who knows it better than you do? Now, here’s an interesting part people should be thinking about, which I’m thinking about: You’ve got two people in a business group. They both have businesses that do, whatever, $10 million a year. And one says, “Oh, I’ve got a 10 percent bottom line.” Wow, that’s great. A million dollars. And the other person says, “Oh, I only have an 8 percent bottom line.” Well, you really have to know how much money’s invested in the business to decide who’s in better shape, because it’s return on investment.

If the person making 10 percent on the business has $3 million of inventory, and the person who makes 8 percent has $200,000 worth of inventory, their return on investment is dramatically better. So you do have to factor that in. And then the question is—and this question isn’t that nebulous—what your bottom line should be. There are a lot of factors. But what your return on investment should be, it certainly shouldn’t be 10 percent. You can almost make that in the stock market and not work.

Laura Zander:

That’s a great question.

Jay Goltz:

Should it be 20-some percent? Yes. Should it be 30? It certainly should be north of 20 percent. Or otherwise, it’s too much work. And I know real estate. I’ve learned that if you do real estate properly, and you leverage it properly, and you charge the right rents, you can make 15 or 16 percent a year on real estate, which is why people get rich with real estate because 15-16% is a lot more than 8 or 9% in the stock market.

Now, when you do what I did by accident, and I did SBA loans, and you only put 10 percent down? Oh my god. Your return on investment could be 30 percent. Because you’ve got very little money in it of your own. So you really need to understand the concept of return on equity versus return on investment.

There’s a difference between how much money you have in the business and how much money is actually your money versus leveraging the bank money. So there is a difference between return on investment and return on equity. We can do it with your business when we’re off the podcast, is take your bottom line, and what is your business worth? What is the inventory worth? And that would be interesting to see.

Using influencer marketing to scale your brand.

Loren Feldman:

So that’s kind of the big-picture strategy that you’re talking about, then. The people you’re reaching out to around the country are influencers who know other influencers.

Laura Zander:

Yes, exactly. You nailed it. Wow. You can just edit all that other stuff out.

Dana White:

I find that influencer marketing is the way to go. That’s something I’ve done differently, Loren.

Loren Feldman:

You struggled with it at first, when you got to Dallas, you told us, Dana. How’s it going now?

Dana White:

So it’s very important that when you put on an influencer event that people who are organizing understand your market. And so there was a young lady there who realized that the event wasn’t going well. And she said, “I’m not confident. I know how much you need this, because I know how much I need this to be here. And I know how important it is that this gets out, because what you’re offering is needed in Dallas. So I will put on another event for you for free. And it will be well attended, and you will be able to get ambassadors from it.” And man, it went gangbusters. Most of our customers right now are coming from TikTok, and we don’t even have a TikTok account. That’s something that we’re going to be working on in the new year.

Loren Feldman:

You’re just reaching out to people who do have TikTok accounts, and are you paying them to promote you?

Dana White:

So what we’re doing is, we gave them a bag of our line of products, all five. And we offered them free services. They came, they tried, they videotaped their experience. They did these blogs and reviews—it was amazing—their before and afters, how the salon looks, pictures of me, videos of me, and they just put out all this content. And everybody loved it. And so now, without even doing any other marketing, we’re seeing our numbers have gone up. Where I thought we would be in March, we’re there now.

And so, I’m like, “Okay, this is great.” And so now, I have to get ready to put myself into it. Everybody I’ve met ever since I’ve owned this business has said, “The business is Dana, the business is Dana.” And the only way I’ve had it be me is by being there in the salon talking to customers. Well, you can talk to customers, and you don’t have to be in the salon. So what I’m working on right now is a way for me to talk to the staff, a way for me to talk to the customers through video, through our social media, through a Facebook Live group. A lot of our customers have a lot of questions about hair care, about what truly is healthy hair care. And there are a lot of myths out there.

The one thing Jay, Laura, and Dana want to do this year that they always say they're going to do, but never get around to.

Loren Feldman:

All right, we’re almost out of time. Real quickly, I’ve got a listener question I’d like you all to answer: What are you planning to do this year that you always say you’re going to do, but never get around to?

Jay Goltz:

I got one. First, no doubt in my mind, every year, especially now, I used to go to my warehouse every week for a production meeting. And because of COVID, I haven’t. I go there now, and I don’t know half the people walking around there.

Loren Feldman:

Don’t know, meaning you haven’t met them, or you don’t know their names?

Jay Goltz:

Maybe I have met them for a minute. So every year I say, “I’ve gotta get a directory with their picture, their name. And when I go over there, I can look at it. And I could walk into the mat department and know her name.” And this year, I told my HR person, “I’m telling you, I want a directory printed out. Go take a picture of everyone.” And I’m doing that this year, because I feel like it’s the least I can do. I’m not saying I’m gonna memorize them. But at least before I walk into the wood department I can look at their names and go, “Hi,” whatever their name is. And I think that’s valuable. And I think that’s the least I can do, for God’s sake. I’m not suggesting I’m gonna go and say, “How’s the kids? What are they up to? Where are they going to school?” But I certainly should know their names. So, this is the year.

Loren Feldman:

Laura, is there anything you’re planning to do this year that you always say you’re going to do, but you never get around to?

Laura Zander:

I want to have budgets fully distributed to each department, throughout all of the companies and all of the brands. And that’s something that I have not quite done yet. But that is going to happen this year.

Loren Feldman:

Because? What’s the goal?

Laura Zander:

The goal is to have people not ask me if they can buy paper clips.

Jay Goltz:

Wow.

Laura Zander:

Yeah. So, I don’t know, “Do you have enough budget left? I mean, you decide. If you want the colored paper clips, and that’s really important to you, great. Good for you.”

Jay Goltz:

Is that really about budgeting? Or is that simply about empowering them to know, “If it’s less than $50, don’t ask me. Just do what you want to do.”

Laura Zander:

It’s a combination of the two. But I think it is about budgeting—because about half of the team has budgets. And it’s really nice, because they know, “I’ve got 100 grand to spend this year.”

Jay Goltz:

You know what, you could fall into the big company problem with, “They’ve got the money, therefore, they’re just going to spend it whether they need to or not.” I don’t necessarily buy into that. Like, either you need it, or you don’t need it. I’m just suggesting, I’d rather train my people, “If you need it, buy it. If you don’t need it, don’t buy it.” To start to go, “Okay, you’ve got $5,000.” Maybe they didn’t need to spend $5,000. Or maybe $5,000 wasn’t enough.

Laura Zander:

This is why it’s taken me so long to do this, because I haven’t done it, is 20 years of data of: How much do we organically spend? So if every year we end up spending $5,000, then that’s what they’re gonna get. And then the message is, “If you need more than this—because I want you to buy it if you need it—then let’s talk. This is a guideline. This is a starting point.”

Jay Goltz:

Sure.

Laura Zander:

And this is not some big bureaucratic, “If you don’t spend it, it’s gonna go down, or anything like that.” And we start slim. And the messaging is, “You buy something if it’s going to make somebody’s life easier, if it’s going to increase efficiency, if it’s going to increase community within the office.”

Loren Feldman:

Dana, how about you? Anything you’re planning to do this year that you always say you’re going to do, but never get around to?

Dana White:

I’ve already started, and I’m actually kind of proud of myself, but I need help with: Numbers, numbers, numbers, numbers, numbers, numbers. Understanding the numbers as if it’s a ball in 3D, and you’re just rotating around the ball. Numbers from top to bottom, front to back, side to side. Also, getting my head out of the sand about the hard stuff. Realizing that because I stick my head in the sand, it makes it harder when I do come up for air.

Loren Feldman:

What’s the hard stuff? What are you referring to?

Dana White:

The hard stuff is having a hard conversation about looking at the numbers. It’s always the numbers for me. It’s like, “Ahhh!” And only feeling better about the numbers when the numbers say something positive back. If the numbers don’t, then I don’t want to look at it. I don’t want to talk about it. I don’t want to do it.

Laura Zander:

Oh, interesting. I bet that’s common.

Jay Goltz:

Absolutely.

Read Full Podcast Transcript Here

.png)